7 Easy Facts About Hsmb Advisory Llc Explained

7 Easy Facts About Hsmb Advisory Llc Explained

Blog Article

Hsmb Advisory Llc Things To Know Before You Get This

Table of ContentsThe Basic Principles Of Hsmb Advisory Llc The Best Strategy To Use For Hsmb Advisory LlcThings about Hsmb Advisory LlcHsmb Advisory Llc - Questions

Life insurance policy is specifically essential if your household is dependent on your wage. Sector experts recommend a policy that pays out 10 times your annual earnings. These might consist of home mortgage repayments, impressive car loans, credit rating card financial obligation, tax obligations, child care, and future college expenses.Bureau of Labor Statistics, both spouses functioned and brought in income in 48. They would certainly be most likely to experience monetary challenge as an outcome of one of their wage earners' deaths., or exclusive insurance coverage you acquire for on your own and your household by calling wellness insurance firms directly or going with a wellness insurance policy representative.

2% of the American population lacked insurance policy coverage in 2021, the Centers for Condition Control (CDC) reported in its National Center for Wellness Stats. More than 60% obtained their protection with an employer or in the personal insurance coverage market while the remainder were covered by government-subsidized programs including Medicare and Medicaid, professionals' advantages programs, and the government industry developed under the Affordable Care Act.

4 Simple Techniques For Hsmb Advisory Llc

If your revenue is reduced, you may be among the 80 million Americans that are qualified for Medicaid. If your income is moderate however doesn't stretch to insurance policy coverage, you may be qualified for subsidized insurance coverage under the government Affordable Treatment Act. The ideal and least pricey alternative for salaried staff members is generally getting involved in your employer's insurance program if your company has one.

Investopedia/ Jake Shi Long-term disability insurance coverage supports those who become not able to work. According to the Social Safety Administration, one in four workers going into the workforce will certainly become handicapped before they get to the age of retirement. While wellness insurance policy pays for hospitalization and clinical bills, you are often burdened with all of the expenses that your paycheck had covered.

Numerous plans pay 40% to 70% of your revenue. The cost of special needs insurance coverage is based on numerous factors, consisting of age, way of life, and health and wellness.

Prior to you buy, check out the small print. Many plans need a three-month waiting duration prior to the protection starts, give an optimum of 3 years' worth of protection, and have significant plan exclusions. In spite of years of improvements in car security, an approximated 31,785 individuals passed away in web traffic accidents on united state

Not known Details About Hsmb Advisory Llc

Comprehensive insurance covers theft and damages to your car because of floods, hail, fire, vandalism, falling items, and pet strikes. When you finance your auto or lease an auto, this sort of insurance policy is obligatory. Uninsured/underinsured motorist (UM) coverage: If an uninsured or underinsured vehicle driver strikes your vehicle, this protection spends for you and your traveler's clinical costs and might additionally account for lost income or make up for pain and suffering.

Company coverage is frequently the most effective option, yet if that is not available, obtain quotes from numerous suppliers as lots of offer price cuts if you purchase even more than one kind of protection. (https://www.find-us-here.com/businesses/HSMB-Advisory-LLC-St-Petersburg-Florida-USA/34004698/)

Some Of Hsmb Advisory Llc

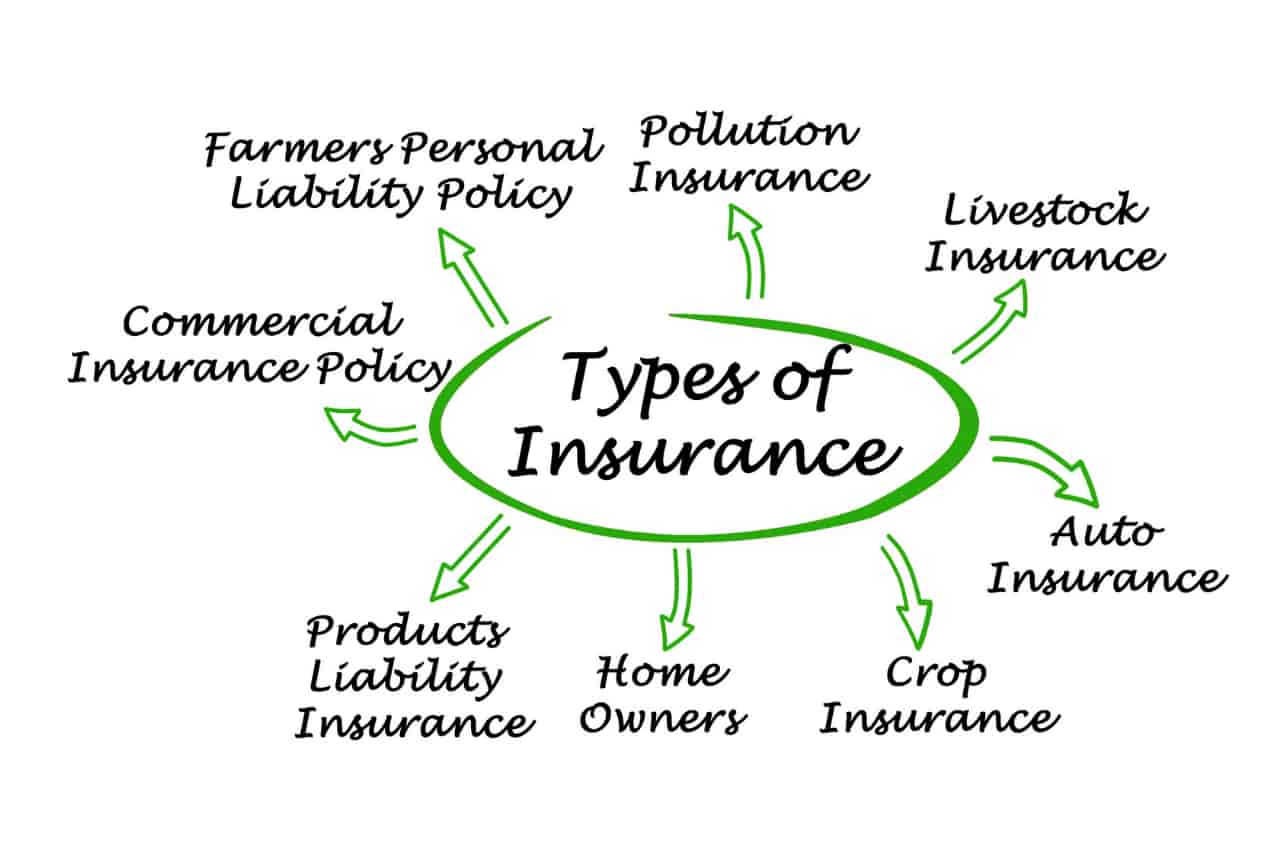

In between health insurance, life insurance policy, special needs, responsibility, long-lasting, and even laptop insurance policy, the job of covering yourselfand thinking regarding the limitless possibilities of what can take place in lifecan really feel frustrating. Once you understand the principles and make sure you're appropriately covered, insurance can enhance economic self-confidence and wellness. Right here are one of the most vital kinds of insurance coverage you need and what they do, plus a pair pointers to stay clear of overinsuring.

Different states have different guidelines, however you can anticipate medical insurance (which many individuals get via their company), car insurance coverage (if you own or drive a lorry), and homeowners insurance (if you own residential property) to be on the checklist (https://penzu.com/p/5ae91d7a36703ec1). Mandatory kinds of insurance policy can transform, so check out the most recent legislations periodically, especially before you renew your policies

Report this page